- Anteneh's Corner

- Posts

- N26: The Complete Guide to Europe's Leading Mobile-First Bank

N26: The Complete Guide to Europe's Leading Mobile-First Bank

N26 is a digital bank founded by Valentin Stalf and Maximilian Tayenthal in Germany and currently operates in Eurozone and plans to expand to US.

It is the Digital Bank that makes your life easier and can free you from the usual inefficient, slow, and expensive traditional banks. Creating an account takes minutes and everything happens on your phone.

Launched in Germany and Austria in January 2015, N26 began as a current account with a Mastercard.

N26 has now more than 2 million customers, oversees a total of 1.5 Billion in transaction every month and raised $212.8M in funding in 5 rounds — and mind you there is no single bank branch.

The main drive behind N26 is frustration in lack of transparency, digital innovation, and personalized service and offerings in the traditional banks. They believed in e-commerce and entertainment, the experience is mobile-friendly and easy to use but most banking products are really difficult for customers, and no one enjoys interacting with them.

Founders of N26 believe that people of all ages are ready for digitally enabled simplicity and seamlessness, especially in personal banking. (“Why can’t we ‘Spotify’ banking?” they ask.)

N26’s strategy is to combine all the complexity of an individual’s financial life — with accounts and cards from many companies — into a single, relatively simple financial-services platform, using cross-service partnerships and alliances to expand the services it offers.

N26 has been embraced particularly strongly by travelers and digital nomads for its wide variety of traveler-friendly features, which include fee-free currency conversion powered by TransferWise and free ATM withdrawals worldwide.

N26 brought personal banking into the modern world. They put all the features and services that a traditional bank offers into a single, simple, seamless mobile app experience. At its core, N26 is a bank account for your phone. But it’s also your Mastercard, your credit provider, your investment portfolio, your savings plan, your insurance broker and much more. Essentially you put the power of your bank inside your pocket.

Let’s look at if that is true.

N26 Basic current account (chequing account)

The basic current account is the main account where many customers use. It is free to use. Here are some key features/ offers of the N26 Basic Current account.

You get a standard Mastercard card

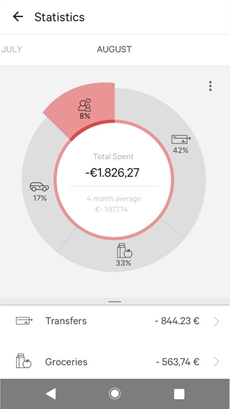

2.Smart Insights — Personalized updates, spending reports, customizable tags. Everything in the app.

2. There is a free foreign currency transfer via Transferwise

4. Over Draft — They do offer an overdraft feature and there is no-penalty fee for it.

It is possible to check your eligibility for an overdraft in 2 minutes without any paperwork and new customers receive up to €1.000 while existing customers are eligible for up to €5.000. You can set your own limit right in the app for easy control over your spending.

Your overdraft interest costs are updated daily in the app, so you always know what you owe and you can track costs directly in the app. — They partnered with WireBank to provide this service. With real-time notifications, we’ll let you know when your balance slips into the negative. Toggle to turn on and off.

In a case where Overdraft is not granted, they send an email in the future as soon as the customers fulfill the requirements.

5. Cash 26 (This feature is only available in Germany)

Whenever you’re buying something from one of N26’s 7,000+ retail partners across Germany (think grocery stores, drug stores, and other high-traffic places), you can select to either withdraw or deposit cash from the app.

The barcode that’s generated for you gets scanned by the cashier in the shop, and then they act as an ATM, either giving you cash or accepting it as a deposit into your account.

With CASH26 You can also put cash on your card up to 100 euro without fee and more with fee 1.5%.This feature similar to M-pesa feature.

6. Invest26

Innvest26 is also a paperless product where you can invest money into an investment fund directly in the N26 app.

When using N26 Invest, you can select one of 3 portfolios, each consisting of 5 funds. They work with there partner vaamo in this case.

You can withdraw money from your investment account at any time; the amount available is displayed directly in the N26 app.

There is a yearly 0,99% fee of your invested amount that will be directly charged from the N26 Invest section of the app and that covers all the expenses for the day-to-day management of your account, and the buying and selling of funds (trading fees, bid-ask spreads, rebalancing).

7. N26 Money Beam

Through a partnership with MoneyBeam, it is possible to send money to your phonebook contacts without knowing their bank account details. If they have N26 bank account, they will receive it immediately.

Payees who are not N26 customers will receive an offline MoneyBeam link, either by text message or email, in which the recipient’s bank account details can be entered. The money will be credited to the given bank account within a period of two banking days. If they don’t accept the MoneyBeam within 7 days, the transfer will be returned to sender account. And it is completely free to make this transaction.

8. N26 Credit

This is a consumer credit where you can get a loan in five minutes. The feature is only live in Germany and works for credit lines between €1,000 and €25,000 for up to five years — interest rates range between 2.99 percent to 8.00 percent p.a.

Behind the scene, N26 can either handle the credit line itself or find a third-party bank for this loan. You’ll tell how much money you need, if you’re single or married, if you’re a homeowner, etc.

They make an offer based on profile and credit history. At the end of the credit check, you’ll instantly get the effective annual rate and how much the credit line is actually going to cost.

You can also customize the length of your loan. You sign with Digital Signature and the money gets deposited directly into your N26 bank account. Customer pays their monthly loan repayment in the app as well.

9. N26 Savings

A savings account directly in the N26 app and earn up to 1.48% in interest. One-time deposit of a fixed sum, starting at €2.000 up to €100.000 for a minimum of 6 Months.

The app shows you the plan with the highest interest rate by default. You can compare plans between several European partner banks so you know you’re getting the best deal possible. (Interest rate)

You can always see the status of your savings plan in the savings section of the N26 app. You can easily access all the information you need like the amount of money you put into the plan, what interest you’ll earn when your plan ends and how much you’ll receive.

This is N26 premium account where you have to pay € 5.90 monthly to access it. Besides everything, the N26 current account provides, N26 Black account provides the following features in addition.

1. Free ATM withdrawals worldwide (zero foreign currency fees).

2. Impressive insurance policy, which includes the following

A. Medical expenses up to an unlimited amount if you have a medical emergency while abroad (No deductible).

B. Expenses you incur due to a flight delay of 4 hours or longer, up to a maximum of €400 (No deductible).

C. Expenses you incur if your luggage arrives more than 6 hours late, up to a maximum of €400 (No deductible).

D. Reimbursement for a stolen mobile phone that was purchased with your N26 BLACK account, up to a maximum of €300 (€50 deductible).

E. Reimbursement for stolen cash if you get mugged up to 4 hours after withdrawing with your N26 BLACK card, up to a maximum of €500 (No deductible).

F. Extended warranty of up to one additional year on items purchased directly with your card and all payment methods associated with your card, such as a linked PayPal account, up to a maximum of €500 (€50 deductible).

G. Travel cancellation insurance on every trip before the trip commences, up to a maximum of €5,000 per trip (10–20% deductible).

A lot of people mention that the N26 Black account card is very good and pretty sleek. They say it feels nice in your hand too because the black upper part of the card is a smooth matte finish.

N26 METAL

This is an ultra-premium account where you get a dedicated customer support person assigned for every customer.

They have also a partner offering for special discounts with companies like WeWork, Hotels.com, IHG, Outfittery and more.

Besides, it is the First metal card in Europe that supports contactless payments. It is an NFC-enabled credit card, NFC meaning Near Field Communication, the kind of technology that allows you to hover your card over a terminal and pay without swiping. To accommodate this technology, the inner core of the card has been changed to tungsten, dramatically increasing the weight of the card. But the card is designed beautifully and to feel like a premium product.

All features of N26 black is included here of course.

Control, Transparency, Instant account management and security

N26 aims to make banking experience non-bs ( as they call it). Here are some interesting feature of the app that you might appreciate.

Real-time transaction notifications. Whenever money goes in or out of your account, whether it’s a transfer you’ve initiated or a pre-authorized payment, you’ll get a notification.

Transaction categories. Every transaction is assigned a category like “Bars & Restaurants” or “Travel & Holidays” to keep track of your spending that way. Just another benefit of having a banking tool built by coders, rather than a piece of technology built by bankers.

PIN resets. Resetting your PIN at any time is as simple as logging into the app and changing it. No calling N26, no trips to the ATM, etc etc. 30 seconds and it’s done.

Locking your card. Just like resetting your PIN, locking your card to make it unusable for a period of time is as simple as logging in and pressing the button. Unlocking it is just as easy.

Payments abroad, online payments and cash withdrawals. For your security, you can toggle these on and off at any time.

Spending and withdrawal limits. Another security feature that you can choose and change in the app at any time.

You can send money with your voice as well with iOS 10, you can activate N26 in your phone’s Siri settings and ask Siri to send money to one of your contacts. “Hey Siri, send €15 to Freddy for lunch using N26.”

N26 Bug Bounty Program — The N26 Bug Bounty Program offers cash rewards to encourage security researchers to inform us about bugs or vulnerabilities, so that we can fix them long before any damage

They have got pretty good reviews rating — 4.4 Rating on Play Store and 4.8 on App Store. I have noticed that they constantly try to respond for a question that is asked and bad comments. Many people seem to feel proud that they use the bank. The Fact that it is simple and easy is also what many customers appreciate. People who travel or work from country to country liked very much as well and constantly say it makes life easier.

Customer service is one of the main things people like. But still there is some disaffection on customer service. There are some bad reviews because of the fact that N26 doesn’t operate in Countries outside of EU.

Onboarding

So you liked it and want to sign up. It is not that hard at all.

To open an N26 account, you need to be at least 18 years of age, permanently resident in any of the supported countries ( Eurozone countries except Cyprus and Malta, for its basic current account and Debit Mastercard products) and own a compatible smartphone.

During registration, you will be asked to provide with your first and last name, e-mail address, address and mobile number, date of birth, nationality, and country of birth. You will also need to provide with a valid ID.

Once you register and your e-mail address is confirmed next will be to verify identity, following one of the following methods, depending on the country in which you are opening the account:

Start a video call with operators, directly from the N26 app

or start the photo verification process, taking a picture of your documents and one yourself from the N26 app (not valid for residents in Germany)

or go to the nearest post office where you will have to show your document (only in Germany).

When you finish registration and you will automatically receive a master card debit card in the address in 2–3 days.

How doe N26 Makes Money?

So you must be wondering how they make money especially if you realize that give many services for free. N26 doesn’t own any physical branch and that helps lower their operational cost significantly. Here are some of the ways they make money.

Subscription fee from N26 Black and Metal account

Withdrawing foreign currency (any currency but Euros) anywhere in the world: 1.7% fee for regular N26 users.

Whenever customers use his card to pay for something, MasterCard gets a cut of the transaction as it manages the payment network. MasterCard then gives back a cut of this cut to the bank that issued the card. So Number26 makes some money from there.

Overdraft interest.

Interest share from investment, savings, credit and insurance features.

Thanks for reading!

This article was initially published on the online platform Medium on January 5, 2019. For those interested in reading the original piece, it may still be accessible on the Medium website.

Social Proof